Intel ruled tech. Now it’s in deep trouble

—

When legendary former Intel CEO Andy Grove wrote his bestseller “Only the Paranoid Survive” in 1996 about how to predict tech inflection points that might undermine a business, the notion that his company might face such a risk was purely theoretical.

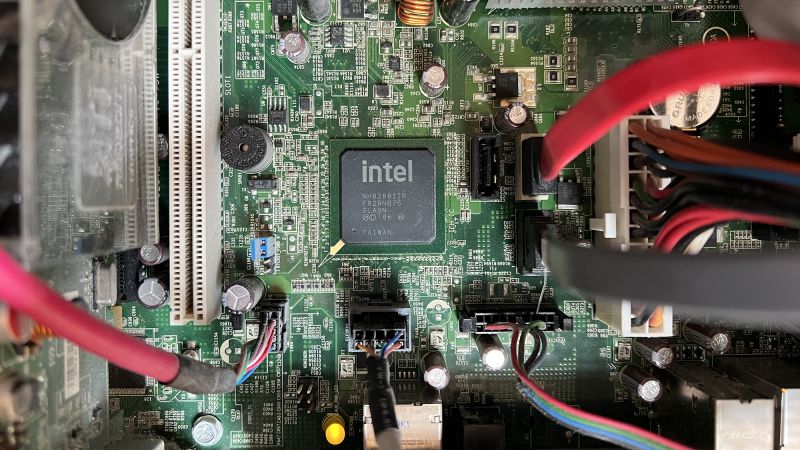

At the time, Intel was the world’s largest producer of computer chips, and its technology was housed inside nearly every PC. Grove’s mission was for his leading American tech company to do more than just supply the parts, but to drive an ambitious vision for the future of computing in which PCs would be used for everything from watching movies and playing games to storing photos and staying connected to friends. Intel would power all of them.

Intel may have predicted the evolution of PCs, but it missed the boat on both mobile computing and the AI boom, the two major technology waves that have defined the past decade and a half. That means nearly two decades after Grove outlined his vision, Intel is a shell of its former self.

Intel’s stock hit its all-time high more than 24 years ago: on August 31, 2000. In recent years it has plunged — it is currently down a stunning 68% from its record.In August, the company said it would lay off 15% of its staff as part of an effort to slash $10 billion in costs. And last month, Intel lost its spot in the Dow Jones Industrial Average to Nvidia, marking the end of a 25-year run that began when it was among the first two technology firms to be included in the blue-chip index.

On Monday, the company announced the retirement of CEO Pat Gelsinger, the decades-long company veteran who was thought of as a sort of prodigal son who would return to fix the company when he took over the top job nearly three years ago. But Gelsinger failed to right the ship. And now, investors and company watchers are seriously questioning whether Intel can ever regain its industry-leading position, despite its importance to American chipmaking.

“The odds of them going back to the glory days, at this point in time, looks very bleak,” said Angelo Zino, technology analyst at CFRA Research.

Missing the mobile wave

The cracks in Intel’s dominance first began to show around 2010. Apple’s first iPhone had launched three years earlier, and the company picked little-known British chip designer ARM to design its processor.

Up until that point, ARM had been seen as a smaller player designing technology for a niche, lower-margin market. But suddenly, mobile devices were the next big thing, offering users many of the perks of a PC right in their pocket. And because ARM was ready with the technology, it quickly leapfrogged Intel as the mobile chipmaking leader.

That shift also foreshadowed a time, years later, when Apple and other device makers dealt another blow to Intel by replacing its processors in some PCs with more efficient, ARM-based chips.

Other rivals, like AMD, also stole market share in the PC business, as they predicted the rise of cloud computing and as Intel struggled to keep pace with the intense innovation timeline that’s come to be known as “Moore’s law,” named after Intel co-founder Gordon Moore, who estimated that chips could be made with twice the number of transistors, increasing their power and speed, every two years.

In 2019, Intel was forced to release a rare public apology after its halting efforts to make more advanced chips exacerbated shortages and delays of its existing products.

Even now, Intel “continues to cede PC/server shares to AMD and ARM,” Bank of America Securities analyst Vivek Arya wrote in a research note Monday. “Meanwhile, PC demand outlook remains grim.”

The company now has around 65% share market share in traditional PCs and 85% share in servers, according to a Monday report from Edward Jones technology analyst Logan Purk.

Behind on AI

When Gelsinger took over in 2021, he was tasked with reviving Intel advanced manufacturing capabilities and getting the company back on a regular pace of innovation.

And during his tenure, Gelsinger “has done a great job on that front,” Zino said.

But while he was focused on improving manufacturing for an existing line of products, another fundamental technology shift was underway that had notable similarities to the mobile evolution that caught Intel flat-footed a decade earlier.

Nvidia — once a tiny Intel competitor making graphics processing units (GPUs) for gaming applications — became, in the span of a few years, essential to the tech industry because those same chips are needed to efficiently power the massive data processing needs of artificial intelligence. Nvidia is now the second-most-valuable company in the world; its $3.4 trillion market value is 33 times bigger than Intel’s $104 billion value.

Intel, once again, didn’t have the products to compete with rivals like Nvidia and AMD in AI, whose innovations are pushing forward the next major technology wave. An AI accelerator chip called Gaudi that Intel released this year in an effort to carve out some share failed to gain the kind of traction the company was hoping for.

Nvidia CEO Jensen Huang said during an interview at a Wired event Tuesday that it’s “probably not unexpected and it’s probably even understandable” that Intel was too focused on its core central processing unit (CPU) chips to predict that the AI boom would demand a shift to GPUs.

Because of “the incredible pace of innovation around deep learning and machine learning, the world went from coding and coding instructions that ran on CPUs to machine learning and neural networks that run on GPUs. This force is so incredible,” said Huang, who called Intel a “really important company.” He added: “It’s not as if you can compete against this … (And) this all happened in 10 years. So, you’re either preparing for that 10-year trend or you get caught off guard by that.”

An uncertain future

At the same time, Gelsinger pushed for a risky and expensive bid to expand the use of Intel’s foundries — historically a point of pride for the company — to manufacture processors for competitors like Apple, putting it into more direct competition with chipmaking giant TSMC. That effort has been central to a push by the Biden administration to revitalize chip manufacturing on American soil. But even that has been dogged by delays.

Uncertainty over Intel’s future product road map and whether it can find sufficient customers for that foundry business to account for the tens of billions of dollars in investment have also made investors antsy.

“They know from their history that having great foundry capabilities as well as great products provide a synergy,” Forrester senior analyst Alvin Nguyen told CNN. “But the thing is, the synergy is only realized when both parts, products and semiconductor foundry aspects, are healthy. And that’s clearly not that situation right now.”

For the new interim co-CEOs who have taken over in Gelsinger’s place – CFO David Zinsner and Michelle (MJ) Johnston Holthaus, who was also elevated from her role as general manager of Intel’s client computing group to the newly-created CEO of Intel products – there is some hope that producing lower-cost, lower-performance but more energy-efficient AI products could be a hit with smaller companies that don’t need the kind of massive computing capacity Nvidia’s pricier chips can provide, Nguyen said. Still, they’ll face real questions about whether the company could be sold to a competitor or certain parts spun off.

Intel’s struggles have raised questions about a potential takeover by a rival like Qualcomm, a possibility that may be more practical under the incoming Trump administration, which is expected to be less aggressive in pursuing antitrust concerns.

Analysts have also raised the possibility of a spin-off of Intel’s foundry unit or an asset sale, but that could be complicated by a massive investment it received from the US government through the CHIPS Act – a national security initiative to fund US chipmakers.

“Intel must retain a majority ownership of its Foundry business to receive CHIPS Act funding, which hinders the potential for an acquisition or spinoff options for this capital-intensive business,” Purk said.

Intel could also stand to benefit if tensions between China and Taiwan, where chip giant TSMC produces many of the world’s processors for other chipmakers, were to ratchet up, Zino said. In that case, chipmakers could look to Intel’s US facilities to make more of their products.

For now, the company is focused on “working to create a leaner, simpler, more agile Intel,” Frank Yeary, Intel’s independent board chair, who was named interim executive chair following Gelsinger’s exit, said in a statement Monday. Investors will be anxiously waiting to learn whether that includes accurately predicting the next major technology wave.

“The fact of the matter is, you have to be able to call the inflections,” Zino said.

Source: https://www.cnn.com